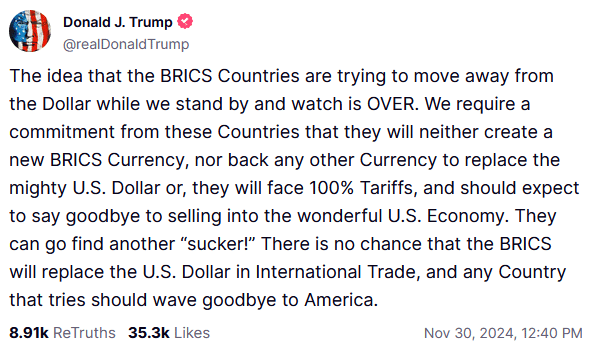

De-dollarization has become the center of discussion worldwide because of a post by U.S. President-elect Trump on his social media platform, Truth Social, on November 30.

In this post, Trump threatened to impose 100% tariffs against BRICS member countries if they seek to undermine the U.S. dollar and create their own currency:

“We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.”

BRICS is an alliance of nine countries: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates. Turkey, Azerbaijan, and Malaysia have applied to join, and several other countries have expressed interest in joining. The original five countries—Brazil, Russia, India, China, and South Africa—formed the bloc in 2009. These countries work together on economic, political, and social initiatives, seeking cooperation and advancing their interest among major emerging economies.

The U.S. dollar is still the most widely used currency in the world, representing roughly 58% of the world’s foreign exchange reserves, according to the International Monetary Fund. Nevertheless, with the growing economic influence of BRICS countries and geopolitical tensions among major powers, countries are starting a de-dollarization process in an effort to become less dependent on the U.S. dollar.

In October, Russian President Vladimir Putin called for a new international payment system at a BRICS summit hosted in Kazan. “The dollar is being used as a weapon,” Putin argued, “We really see that this is so. I think that this is a big mistake by those who do this.”

Putin was not the only world leader who supported exploring alternative currencies beyond the U.S. dollar. In 2023, Brazilian President Luiz Inácio Lula da Silva proposed creating a new, common currency in South America to reduce its reliance on the dollar in international trade.

How have these ideas been received in the China? Below is a translated article from Hu Xijin, the long-time editor-in-chief of Global Times. As China Media Project recently reported, Hu’s social media accounts went silent in in July after he posted his interpretations of the Politburo’s Third Plenum decision. Whatever the reason for his hiatus, Hu began posting again in November to the welcome of his considerable audience. Controversial for people on both sides of the Pacific, Hu nevertheless remains an important voice for the size of his readership alone and in some cases has been the voice of reason against the excesses nationalism. His thoughts remain worth following.

Trump Issues Stern Warning to BRICS

by Hu Xijin

Trump has issued a strong threat to BRICS countries. On November 30, Trump posted a fiery message on his social media platform, Truth Social, demanding that BRICS countries abandon any plans to create a new currency or support alternatives to the U.S. dollar. Otherwise, he warned, he would impose a 100% tariff on any country challenging the dollar’s dominance in the global economy.

This is perhaps the harshest foreign policy statement Trump has made since his election victory, but it is also one of the most incoherent and indefensible.

Indeed, in recent years, BRICS countries have discussed reducing their reliance on the U.S. dollar through potential alternative currencies or new trade mechanisms, an initiative primarily driven by Russia. Facing harsh sanctions from the U.S. and the West, Russia’s trade with the U.S. has largely diminished. Even though trade slightly rebounded to $320 million in April this year, it is a negligible amount. Thus, even a 200% tariff would not faze Moscow.

It is well known that Putin has been eager to promote the cross-border payment system known as “BRICS Bridge,” but Russia’s motivations are easy to understand. Since the start of the Russia-Ukraine war in February 2022, the U.S. quickly removed Russia from the Washington-controlled international settlement system SWIFT. This action was seen as a “nuclear-level” financial sanction. Furthermore, banks from any country facilitating trade with Russia face sanctions, making Russia the most eager major power to escape the “dollar cage.”

Objectively speaking, while BRICS countries share many political and economic interests and hope to increase the use of their local currencies in international trade, realizing Putin’s vision of a “BRICS currency” in the short term is fraught with challenges. The differences in their economic systems and the independence of their monetary policies are irreconcilable contradictions.

Brazilian scholar Marina Moreno noted that coordinating monetary policies among a group of developing countries with such diverse economic systems is difficult and making this idea a reality will take a long time. She cited the example of the European Union, which took 34 years to establish a unified currency.

The global financial system is deeply dependent on the U.S. dollar, whose structural advantages cannot be dismantled overnight. The dollar, supported by strong market demand and liquidity, dominates as the global reserve currency and trade settlement currency. Even with a strong desire to de-dollarize, achieving this goal in such a complex international environment is highly challenging.

Nonetheless, more and more countries are seeking to use non-dollar currencies for international trade to varying degrees, and this de-dollarization trend is spreading.

The dollar is America’s “money tree,” and Washington’s concerns are understandable. However, Trump is blaming the wrong people. In reality, de-dollarization is driven largely by U.S. policies themselves. Trump also undermined the dollar during his previous term. Washington is, without a doubt, “reaping what it sowed.”

First, America’s frequent use of economic sanctions and trade wars has disrupted the foundation of the dollar’s dominance. A prime example is the use of the SWIFT system to sanction countries like Russia and Iran, excluding them from global payment systems and coercing third-party financial institutions to comply. The dollar has become a tool of “domination” rather than “service.” This transformation has caused harm to the excluded countries and institutions, prompting a global reflection and backlash against dollar hegemony. Reducing dependence on the dollar and enhancing the safety of national international payments have become widespread global goals.

Saudi Arabia, a key U.S. ally and a cornerstone of the petrodollar system, stated in September through its Minister of Industry and Mineral Resources that it is open to new ideas, including using the yuan for cross-border oil trade. Russian Prime Minister Mikhail Mishustin announced in August that over 95% of bilateral trade between Russia and China is now settled in their local currencies. From 2021 to 2023, the ruble’s share in Russian export payments nearly tripled, reaching 39%.

In 2023, leaders of Brazil and Argentina expressed their intention to establish a common currency for South America. Since January, the UAE and India have used their local currencies for direct trade. Malaysian Prime Minister Anwar Ibrahim also voiced support for bilateral trade between Malaysia and India in their local currencies. Malaysia’s central bank agreed to expand the use of the two nations’ currencies.

As international trade expands, dollar-denominated transactions require sufficient dollar supply. The dollar’s global dominance depends on America’s willingness to maintain trade deficits. In other words, the dollar’s role as a global reserve and settlement currency is inherently tied to the U.S.’ openness to imports and trade deficits, a complex reality that must be objectively acknowledged.

Trump, however, opposes globalization and frequently wields the “tariff stick” to block foreign goods from entering the U.S. He wants the dollar to dominate globally while simultaneously bringing manufacturing back to the U.S. and turning the U.S. into a trade surplus nation.

Trump seems unaware that if the U.S. becomes a surplus country, dollars would flow back to the U.S., inevitably undermining the dollar’s status as the global reserve and settlement currency, allowing other currencies to take its place.

On the same day, Trump issued his warning to BRICS, Michael Pettis, a senior fellow at the Carnegie Endowment for International Peace, remarked that this warning illustrates “how confused the new administration is about global trade and capital systems.” Pettis posted on his X account, “The U.S. cannot simultaneously reduce its trade deficit and enhance the global dominance of the dollar, as these two objectives impose fundamentally opposing conditions.”

Trump and his team should figure out what they truly want. Trying to have it all might end up being a self-inflicted wound. Such contradictions could make the U.S. the laughingstock of the 21st century.